Planning your dream vacation? Don’t forget to include travel insurance in your checklist. Whether you’re jetting off for a weekend city break or embarking on a month-long adventure, travel insurance can be a lifesaver when things don’t go as planned. In this article, we’ll discuss the benefits of different travel insurance options, including medical coverage and trip protection, and introduce you to some of the best providers like World Nomads, Allianz Travel Insurance, and SafetyWing. Let’s dive in to find the perfect travel insurance plan for your needs.

Why You Need Travel Insurance

Unexpected events can happen when you least expect them. From flight cancellations to sudden illness or injury, travel insurance provides a financial safety net that can save you from unexpected expenses. The key benefits of travel insurance include:

- Medical Coverage: If you fall sick or get injured during your trip, travel insurance can cover hospital stays, emergency medical evacuations, and even repatriation.

- Trip Cancellation and Interruption: Protects your prepaid travel expenses if you need to cancel or cut short your trip due to covered reasons such as illness, family emergencies, or natural disasters.

- Lost or Delayed Luggage: Coverage for lost, stolen, or delayed baggage can help you replace essential items and continue your journey with peace of mind.

Top Travel Insurance Providers

1. World Nomads: Best for Adventure Seekers

World Nomads is a popular choice for travelers who love adventure and off-the-beaten-path experiences. Their plans cover a wide range of activities, from hiking and diving to skiing. World Nomads offers:

- Comprehensive Medical Coverage: Coverage for accidents, injuries, and medical evacuations.

- Trip Cancellation: Protects your travel investment if you have to cancel your trip due to covered events.

- 24/7 Emergency Assistance: Access to emergency assistance services no matter where you are in the world.

Why Choose World Nomads? If you’re an active traveler looking for a flexible plan that covers a variety of adventure activities, World Nomads could be the perfect fit.

Get a quote from World Nomads here.

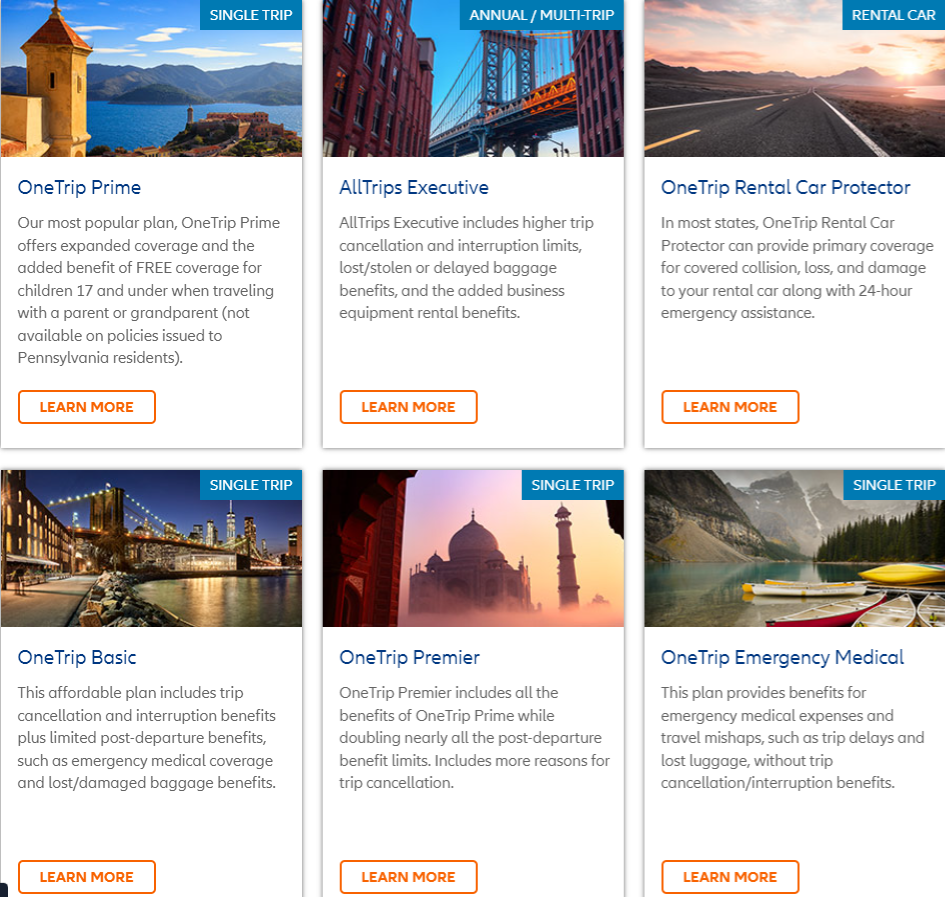

2. Allianz Travel Insurance: Best for Frequent Travelers

Allianz Travel Insurance is a reliable option for both occasional and frequent travelers, offering customizable plans with a strong reputation for customer service. Allianz stands out for:

- Medical and Dental Coverage: Coverage for emergency medical and dental treatment during your trip.

- Trip Interruption and Delay: Reimbursement for expenses due to travel delays and interruptions.

- Annual Plans: Ideal for frequent travelers who want continuous coverage without the hassle of buying a new plan for each trip.

Why Choose Allianz? With its broad range of plans and the option for annual coverage, Allianz is great for those who travel multiple times a year.

Get a quote from Allianz Travel Insurance here.

3. SafetyWing: Best for Digital Nomads and Long-term Travelers

SafetyWing is designed for digital nomads, remote workers, and long-term travelers. They offer affordable monthly plans that are ideal for those who plan to be abroad for extended periods. Key features include:

- Affordable Medical Insurance: Includes coverage for hospital stays, doctor visits, and emergency medical evacuations.

- Coverage in Your Home Country: SafetyWing provides coverage in your home country for short visits, making it convenient for those who often travel back and forth.

- Customizable Monthly Plans: Cancel anytime, making it flexible for those with unpredictable travel plans.

Why Choose SafetyWing? If you’re a long-term traveler or remote worker looking for an affordable insurance plan that you can customize, SafetyWing is a great choice.

Get a quote from SafetyWing here.

How to Choose the Right Travel Insurance Plan

Choosing the right travel insurance plan depends on your travel style, destination, and the type of coverage you need. Here are a few tips to help you decide:

- Consider Your Activities: If you’re planning adventurous activities, ensure your plan covers them.

- Check for COVID-19 Coverage: Some providers offer coverage for COVID-19-related cancellations or medical expenses.

- Compare Deductibles and Limits: Pay attention to deductibles and coverage limits to find a plan that suits your needs.

Final Thoughts: Travel with Confidence

Travel insurance is an essential part of any trip, providing the peace of mind that you’ll be protected no matter what happens. World Nomads, Allianz Travel Insurance, and SafetyWing each offer unique benefits tailored to different types of travelers. By choosing the right travel insurance plan, you can focus on making memories, knowing you’re covered in case of unexpected events.

Ready to protect your trip? Compare plans from World Nomads, Allianz Travel Insurance, and SafetyWing to find the best option for you. Safe travels!